James Perrin

December 12, 2023

At Australian Impact Investments (Aii), we traditionally focused on private market investment opportunities. In 2021, our clients presented us with a question – how do you identify a listed equity or fixed income fund that is true-to-label and represents ‘best-practice’ values-aligned investing?

In theory, this is a simple question. However, the ever-increasing number of funds labelled ‘responsible, ‘sustainable’, ‘ethical’, ‘Environmental, Social and Governance (ESG), or ‘impact’, can make it difficult for responsible investors to find the product that best matches their needs.

In response, we developed our Responsible Investment Matrix (RIM), based on based on our multi-decade experience with values-aligned investing, alongside an iteration of factors identified in the Impact Management Project (now Impact Frontiers), to assess a combination of investment philosophy, processes, actions, and potential additionality offered by a public markets fund.

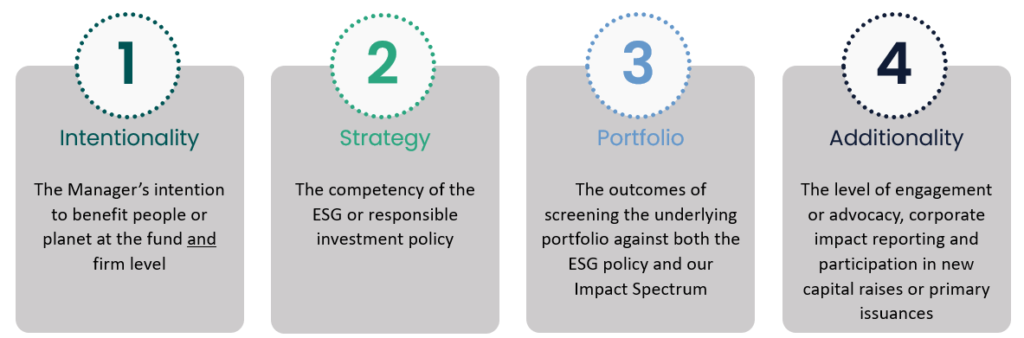

The RIM measures four key requirements of a best-practice responsible investment fund: Intentionality, Strategy, Portfolio, and Additionality (see Figure 1).

Figure 1: Our Responsible Investment Methodology

We look past the product name and assess whether the fund’s market strategy, investment strategy and underlying portfolio truly deliver values-alignment to investors.

Intentionality

To assess manager Intentionality, we look for a stated purpose around philosophy, processes and portfolio management: Does the manager understand the values alignment concerns most relevant to investors? Is there evidence of responsible business practices across the firm?

Strategy

To assess a fund’s Strategy, we investigate whether a rigorous responsible investment policy has clearly articulated goals, a negative and/or positive screening process consistently used, and the allocation of resources to responsible investment due diligence across the team.

Portfolio

We look at every underlying holding in a fund and assess them against our Impact Spectrum. We classify each holding according to the products and/or services offered, and the way in which it operates to determine its impact on people and planet. This contrasts to ESG integration, which focuses on how responsible investment risks affect the company’s operations.

See Understanding our Impact Spectrum for more details on this process.

Additionality

Achieving additionality – sustained change in inputs, outputs or behaviour – requires incremental effort. For public market products like listed equities and fixed income, whether the majority of transactions are made in secondary markets, we look for evidence of active engagement with companies or bond issuers, advocacy on values-alignment issues and consistent monitoring of portfolio company operations. Voting on director remuneration and (re)election is insufficient to fulfil our advocacy criteria; explicit examples of activity related to responsible investment criteria and sustainability are required.

The RIM in Practice

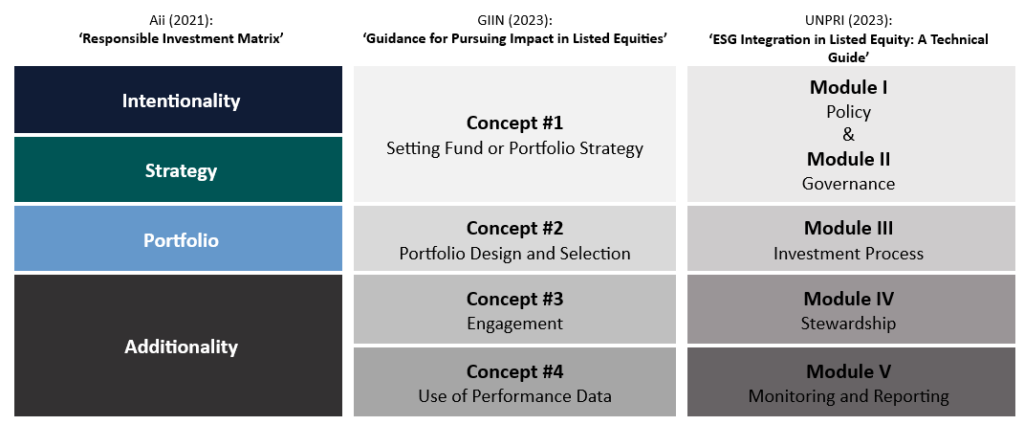

We first developed the RIM in 2021, and it is encouraging to see alignment between our process and that of global industry bodies in recent months. The Global Impact Investing Network (GIIN) and United Nations Principles for Responsible Investment (UNPRI) both released guides for responsible investors that align with the RIM:

Figure 2: Comparing the RIM

We encourage all investors to consider the impact of their investments on people and the planet, and the RIM provides a useful framework for thinking about that impact.

If you would like to learn more about our public markets research, or want to see your own portfolio measured against the RIM, we encourage you to reach out to the team, we’re here to help.