Caitlin James

December 12, 2023

With the rise in consciousness of the positive and negative impact of investment dollars on the world around us, there has been a noticeable trend among more and more investors striving to incorporate impact considerations alongside risk and reward factors in their portfolios.

In working with clients to assist them on the path to integrating impact, we developed what we refer to as a ‘total impact portfolio’, intentionally evaluating and managing risk, reward and impact for an investor., whether they are a retail investor, family office, foundation, or institution. We have also identified four stages investors move through on their impact journey towards a total impact portfolio.

What is a ‘Total Impact Portfolio’[1]

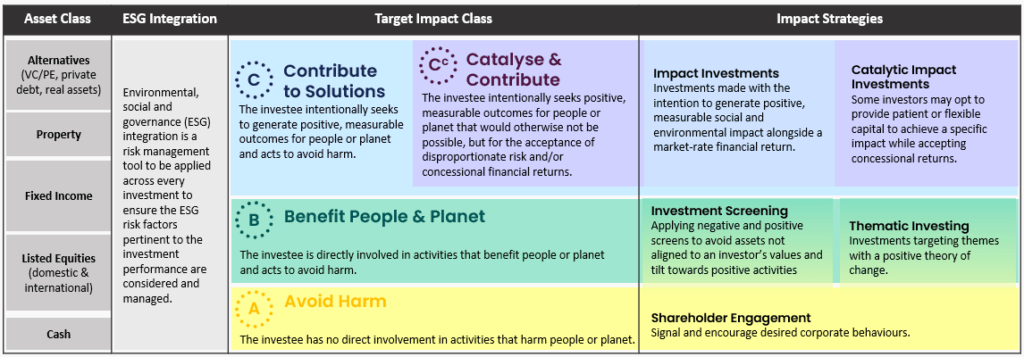

A total impact portfolio assesses impact across every investment in an investment portfolio, adopting a range of approaches to managing impact, from investment screening through to impact investing. In practice it involves investors applying a ‘target impact class’ to each asset type, in much the same way they would use a strategic asset allocation. Figure 1 demonstrates this dynamic against our Impact Spectrum[2]:

Figure 1: Total Impact Portfolio

The Four Stages of an Impact Journey

Adopting a total impact portfolio that successfully blends impact and financial objectives is a journey. That journey is rarely a sequential process, as each investor will set out on a unique path to achieve a total impact portfolio. After all, every asset owner has its own stakeholders, portfolio, and investment requirements.

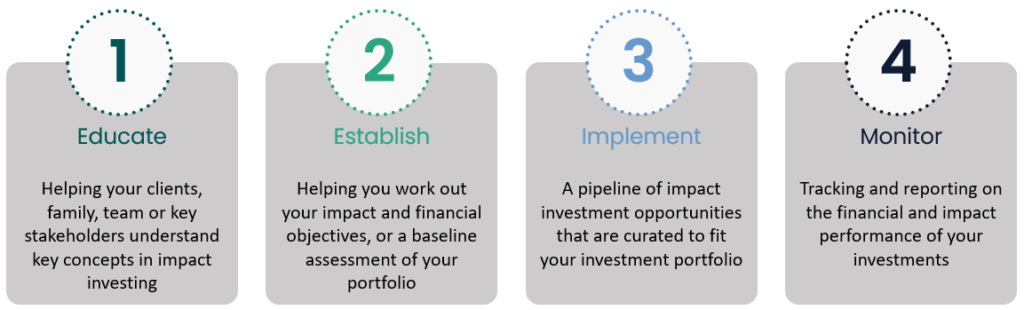

Our work with asset owners and wealth advisers over the past nine years, has allowed us to be build deep understanding of the impact journey and the four stages to truly embedding impact in a portfolio:

Every investor takes a different approach to embedding impact in their portfolio, and each takes the journey at a different pace. Some adopt a total impact portfolio from day one, while others expanded from an impact allocation over time. Below, we explain the four stages of the impact journey we have observed, along with some examples from our clients.

1.Educate

First, asset owners may need to explore the key concepts, strategies and tools underpinning an impact portfolio and define their objectives and strategic priorities. Depending on the nature of the asset owner, this exploration might include family members, senior management, directors, investment committee, and other stakeholders.

Established in 2019, Macdoch Foundation initially focused on building a granting strategy that would drive significant shifts in agriculture and food systems, climate change solutions and healthy communities. Just as it recognises the connection between a healthy planet and healthy communities, the Foundation appointed Aii in early 2023 to help align its investment portfolio with its purpose and use that portfolio to amplify its impact.

2. Establish

The second step is to establish a baseline for a portfolio. This could involve sitting down with stakeholders to agree on values, impact goals and financial objectives or completing an impact analysis of an existing portfolio to understand where it might trigger values alignment concerns. Ultimately, these values, impact goals and financial objectives need to be embedded into investment policies and frameworks, guiding decisions makers to account for and balance each of these elements for each investment and the portfolio.

The Siddle Family Foundation is one of an increasing number of charitable trusts and foundations seamlessly integrating responsible and impact investment into its DNA from day one. Appointed as adviser in 2022, Aii supported the Foundation to develop an inaugural investment policy statement that aligns impact goals with financial objectives, ensuring that every investment decision serves a dual purpose – preserving and growing the corpus and generating positive impact. Recognising the corpus as the cornerstone of its capacity, the Foundation’s financial objectives underscore its vital role in funding and supporting its mission to create safe homes that enable families to thrive.

3. Implement

Now comes the exciting part – deploying capital to investment opportunities that align with stated values, impact goals, and financial objectives. The process begins with thorough due diligence of potential investments, scrutinising their capacity to generate measurable and sustainable impact, while gaining comfort on the financial risk-return profile. With a universe of investments identified, portfolios are constructed from those that align with clients’ financial objectives and impact goals.

For more than fifty years, The William Buckland Foundation has been providing philanthropic funding to Victorian charitable organisations. In [2017], recognising the opportunity to further its impact through investing, the Foundation set a goal to allocate a proportion of its portfolio to impact investments. Sourcing investment opportunities that met its impact goals and financial objectives was challenging, so in 2023 the Foundation appointed Aii to support its impact allocation.

4. Monitor

Adhering to the principle that ‘you can’t manage what you don’t measure’, financial and impact performance monitoring is integral to our investment approach. Regular assessments inform decisions, pinpoint areas for improvements, aid alignment with impact goals and financial objectives, and fortify risk management. Monitoring provides valuable insights into market trends, empowering asset owners to navigate evolving investment environments.

AMP Foundation has worked with Aii since 2019 and has a 10% allocation to impact investments in its corpus. Regular monitoring and reporting on its impact allocation has been an important element of the relationship since day one.

We understand that each investor’s impact journey is a unique process. Whether you are new to impact investment or already progressing on your journey, we encourage you to reach out to the team to explore how we can assist and support you along your path.

[1] We first published our Total Impact Portfolio in our 2022 Impact Report and continued to iterate on the strategy to take account of emerging best practice from clients and peers.

[2] More details on the Impact Spectrum can be found in our article, Understanding the Impact Spectrum